Why this matters

When you’re buying data you’re not just buying a list. You’re buying insight, velocity, accuracy, and—ideally—a partnership. If you treat a data provider like a generic vendor, you risk ending up with “90 % accurate” data that’s aged before go-live. So let’s get this RFP right.

Step 1: Clarify Your Goals and Team

Before you start drafting an RFP, you need absolute clarity on why you’re doing it, what you need, and who is driving the process. This is the foundation that will determine whether your RFP becomes a roadmap for success—or a bureaucratic detour.

A. Gather the Right Stakeholders

Every great RFP starts with the right people in the room.

- Marketing Operations: Understands campaign targeting, segmentation, and automation requirements.

- Sales Operations: Knows what reps actually need—account hierarchies, contact accuracy, and lead routing.

- Revenue Operations: Ensures data aligns with pipeline metrics and GTM strategy.

- Data Science or Analytics: Brings rigor to data quality standards and integration needs.

- Revenue Leadership (VPs of Sales/Marketing): Provides business context and outcome-driven priorities.

📘 Pro Tip: Treat this kickoff like a mini-discovery workshop. Ask each stakeholder, “What do you wish our current data provider did better?” You’ll uncover frustrations and gaps that shape your RFP scope.

B. Define the “Why” Behind the RFP

Don’t start by asking, “What data do we need?” Start by asking, “What business problem are we solving?”

Examples:

- Market Expansion: You’re entering new regions or verticals and need coverage outside your existing datasets.

- ICP Evolution: Your ideal customer profile has shifted (e.g., mid-market SaaS instead of enterprise financials).

- Signal Enrichment: You need behavioral or operational triggers (funding, hiring, ownership change, new product launches).

- Technographic Coverage: You’re moving to account-based selling and need verified install data.

- Data Hygiene: You need real-time updates, deduplication, or compliance verification.

🎯 Think like a strategist, not a buyer. The goal is to describe the outcomes you want—not just the features you lack.

C. Align on Must-Haves vs. Nice-to-Haves

Every stakeholder will come to the table with their wishlist. Your job is to prioritize.

Must-haves are non-negotiables that affect go-to-market execution—like CRM integration, API access, and compliance coverage.

Nice-to-haves add value but aren’t mission-critical—like intent data overlays or prebuilt dashboards.

Use a 2x2 matrix (Impact vs. Urgency) to visualize and agree as a team. This avoids misalignment later when vendor proposals start rolling in and priorities compete.

D. Research the Landscape

The B2B data ecosystem has evolved. The choices are no longer just “buy ZoomInfo or Apollo.”

Here’s how to segment your options:

- List Providers: Prebuilt, static datasets; good for basic coverage, weak for customization.

- Enrichment Providers: Focus on keeping your existing CRM clean and appended.

- Signal Providers: Surface event-based insights (hiring, funding, product launches).

- Bespoke Data Providers (like LeadGenius): Custom data models, real-time sourcing, and tailored enrichment at scale.

🧭 Action Step: Build a market map of 5–7 potential providers. Note what each one excels at and where they fall short (e.g., global coverage, compliance, customization).

F. Assign Roles and Accountability

An RFP isn’t a solo project—it’s a relay race.

Clearly define:

- RFP Owner: The person responsible for creating and distributing the document.

- Technical Reviewer: Ensures integration and compliance requirements are accurate.

- Evaluator Panel: Cross-functional team that scores responses using a common rubric.

- Vendor Liaison: Handles communication, Q&A, and demo scheduling.

- Executive Sponsor: Keeps momentum and makes the final decision.

💡 Best Practice: Use a shared evaluation tracker (Google Sheet or Airtable) where each stakeholder rates vendors independently before the group review. This prevents early bias and keeps discussions objective.

G. Document Your Internal Consensus

Before sending the RFP, write a short internal summary that answers:

- What is the business outcome we’re solving for?

- What are our must-have capabilities?

- Who owns which part of the evaluation?

- What does success look like six months after implementation?

This document becomes your North Star. When vendor responses start flooding in, it keeps the team grounded and aligned.

In short:

Before a single vendor sees your RFP, you should have a unified internal vision, a shared vocabulary of success, and clarity on how you’ll evaluate what “good” looks like. Without that foundation, every vendor demo will sound the same—and every decision will feel like a guess.

Step 2: Structure the RFP Document

Writing an RFP is a little like writing a screenplay: you’re setting the stage, defining the characters, and giving each player the lines they need to deliver a great performance. The clearer your structure, the better the story your vendors can tell—and the easier it becomes for you to compare them objectively later.

Below is a recommended framework—adapted for teams evaluating B2B data providers or enrichment partners—so you can build an RFP that elicits meaningful, comparable responses rather than vague marketing fluff.

A. Cover / Intro

Start with context and courtesy.

- Purpose: Introduce who you are and why you’re issuing this RFP. Keep it warm but professional—“We’re evaluating partners to help us improve data coverage and accuracy for our global go-to-market operations.”

- Timeline snapshot: Include key dates for vendor questions, submission deadlines, and anticipated decision.

- Contact: Identify the RFP lead and their email for all communications.

- Tone tip: This is your first impression. If you sound open, thoughtful, and organized, you’ll attract responses of the same quality.

📘 Example:

LeadGenius is seeking a data partner that can deliver verified global company and contact intelligence across multiple signals (firmographic, technographic, hiring, and funding). Our goal is to improve the precision and timeliness of our go-to-market motion.

B. Background & Context

Help vendors understand your world, not just your wishlist.

- Describe your business model, GTM motion, and markets you serve.

- Explain current challenges with your existing data approach—coverage gaps, refresh frequency, or limited insight depth.

- If you’ve used other vendors, briefly note what worked and what didn’t (without naming names).

- Mention your CRM or MAP environment (e.g., Salesforce + HubSpot + Marketo) so vendors can address integration specifics.

🎯 Why it matters: The more context you share, the better vendors can tailor their responses to your specific ecosystem instead of giving you a boilerplate pitch.

C. Objectives & Scope

This section is the RFP’s north star—define what success looks like.

- Articulate your business objectives (e.g., “Expand verified account coverage by 30 % in EMEA and APAC,” or “Reduce bounced email rates by 40 %”).

- Specify the functional scope:

- Firmographic + Technographic coverage

- Hiring / Funding / Ownership signals

- Parent-subsidiary hierarchy mapping

- Contact enrichment (titles, roles, emails, phone)

- API or CRM integration requirements

- Include scale expectations (number of records, frequency of refresh).

📈 Example:

Success means weekly data refreshes across 100 K accounts in North America and EMEA, including verified contact data, active hiring signals, and company hierarchy visibility within Salesforce.

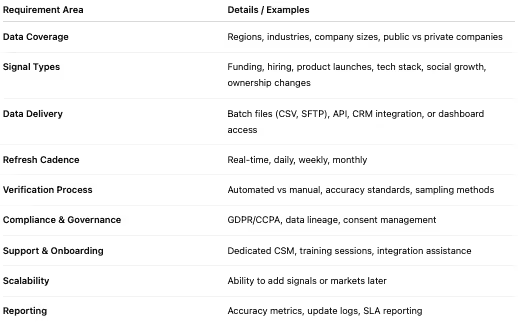

D. Requirements & Deliverables

Now get granular. Treat this as your technical spec and service wish-list combined.

Break it down by category:

💡 Illustrative Tip: Attach a one-page “Data Dictionary”—your definitions for things like hire spike, product launch, or ownership change. Vendors will appreciate the clarity, and you’ll ensure apples-to-apples responses.

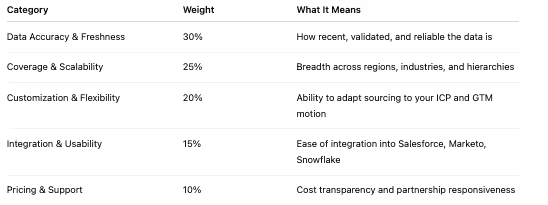

E. Evaluation Criteria

Make your scoring rubric explicit—it guides vendors toward what you actually care about.

- Accuracy & freshness (30 %)

- Global coverage & hierarchies (20 %)

- Customization & scalability (20 %)

- Integration & ease of use (15 %)

- Support & partnership model (10 %)

- Price & flexibility (5 %)

📘 Pro Tip: Include the rubric in the RFP. Transparency encourages targeted, thoughtful responses and reduces post-submission noise.

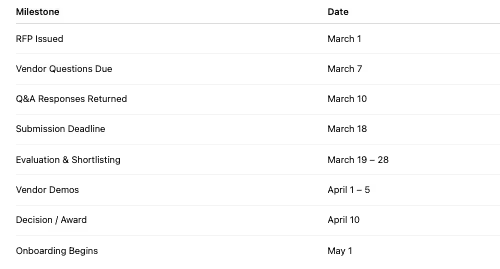

F. Timeline

Create a visual timeline or table that keeps everyone honest:

⚙️ Why it matters: Good vendors are busy; clear deadlines show you respect their time and signal professionalism.

G. Submission Instructions

Remove ambiguity—vendors should never wonder how to respond.

- Required format (PDF + Excel template for pricing).

- Submission method (email, procurement portal).

- Word / page limits.

- Clarify whether multiple attachments or embedded visuals are acceptable.

- Provide a question template: “List any clarifications you need in this table.”

💬 Pro Tip: Specify file-naming conventions and how you’ll handle late submissions to keep evaluation fair and orderly.

H. Sample Data / Proof of Capability

For data vendors, this is your truth test.

Ask for a realistic, scoped sample that mirrors your intended use case:

“Provide 100 accounts and contacts in the U.K. mid-market manufacturing sector with technographic and hiring signals updated within the last 30 days.”

Then specify what you’ll evaluate: freshness, accuracy, completeness, hierarchies, and CRM readiness.

🎯 Why: Seeing data in action beats any slide deck. It’s the fastest way to separate marketing claims from actual capability.

I. Contract / SLA Expectations

Set expectations early so legal doesn’t become a roadblock later.

Include guidelines around:

- Uptime and availability (for API or portal access)

- Accuracy commitment and error thresholds

- Refresh frequency and update cadence

- Support response times and escalation paths

- Data security and storage standards

- Ownership and usage rights of enriched data

📘 Example:

“Data accuracy must remain above 95 % with monthly re-verification. API availability must exceed 99.5 % uptime.”

J. Budget & Commercial Terms

You can either state your budget range or invite vendors to propose pricing models.

Include questions like:

- “Describe your pricing structure (per record, per signal, per seat, or annual license).”

- “What volume tiers or discounts apply?”

- “Are there additional fees for API access, training, or support?”

💡 Why: This section flushes out hidden costs that could erode ROI later and helps you compare true cost of ownership.

K. Appendices & Supporting Materials

Round out your RFP with resources that make it easier to respond well.

- Glossary: Define internal terminology (hire spike, subsidiary entity, usage density).

- Data Architecture Overview: How your systems connect (CRM, MAP, BI tools).

- Sample Record Template: Show vendors how you expect their data structured.

- Compliance Statement: Your standards for data handling and security.

- Scoring Matrix Template: Optional Excel sheet vendors can mirror for easy review.

Bringing It Together

Think of the RFP document as a mutual blueprint—not a test.

A well-structured RFP helps vendors understand your world and respond with precision, which means you spend less time chasing clarifications and more time evaluating real solutions.

If Step 1 was about alignment internally, Step 2 is about communicating that alignment externally—clearly, transparently, and in a way that makes great vendors want to work with you.

Step 3: Best Practices for Your RFP

An RFP is a communication tool—not a compliance exercise. The goal isn’t to make vendors jump through hoops; it’s to make them show you what they’re truly capable of. The best RFPs invite clarity, creativity, and partnership. Below are expanded best practices, with insights from established RFP frameworks (ZipHQ, SupplierGateway, Responsive.io, Sievo, Harvard GovLab) and tailored commentary for B2B data buying.

A. Be Clear and Concise

You’re not writing a legal document—you’re writing a blueprint for collaboration. Avoid jargon, long-winded descriptions, and vague goals.

- Write in plain English: “We need verified global contact data with hiring and funding signals refreshed weekly.”

- Replace buzzwords (“360-degree intelligence”) with measurable outcomes (“20% more coverage across top 3 regions”).

- Assume your reader doesn’t know your acronyms—define MAP, ICP, and GTM once, then move on.

💡 Why it matters: Clear RFPs attract quality vendors. Confusing ones repel them—or worse, invite templated answers that waste everyone’s time.

B. Invite Innovation, Not Just Compliance

Too many RFPs treat vendors like checkbox machines. Instead, ask them to think with you.

Encourage responses that propose alternative solutions or enhancements you may not have considered.

For example:

“If there’s a more efficient way to achieve this outcome than the methods listed, please describe your approach.”

- Give vendors freedom to recommend additional signals, automation workflows, or predictive models.

- Ask for their point of view: “What’s one data insight or sourcing practice we’re not asking for—but should be?”

📘 ZipHQ’s insight: “The most valuable RFPs invite vendors to think creatively. Let them show you what’s possible, not just what’s listed.”

C. Define Must-Haves vs. Nice-to-Haves Early

This single step saves weeks of internal debate later.

- Must-haves: Core capabilities critical to operational success (e.g., CRM integration, global coverage, compliance, refresh rate).

- Nice-to-haves: Enhancements that improve efficiency but aren’t deal breakers (e.g., built-in dashboards, additional signal types).

Create a simple weighted scorecard that assigns numerical values to each category (e.g., 5 points = mandatory, 1 point = optional).

💡 SupplierGateway’s reminder: “Separate needs from wishes. It ensures your evaluation focuses on what truly drives value.”

D. Make Evaluation Criteria Transparent

Let vendors know what matters most to you and how they’ll be scored.

Example criteria for a data provider RFP:

Responsive.io suggests defining criteria early to keep decision-making objective and repeatable. It also helps vendors tailor their responses to your priorities.

E. Provide Background and Context

Never assume a vendor understands your business model or sales motion.

Include a brief “About Us” section that explains:

- Your industry, core customers, and target geographies

- How your GTM teams (sales, marketing, ops) use data

- The pain points you’re solving (stale data, poor match rates, lack of signal depth)

- Key systems and integrations (Salesforce, HubSpot, Snowflake, etc.)

🎯 Sievo notes: “Context builds better proposals.” The more you share, the better vendors can craft solutions that match your operational reality.

F. Allow Vendor Q&A and Manage Timelines Thoughtfully

Build in a vendor question window (typically 5–7 business days after release) so suppliers can clarify ambiguities before submitting.

- Gather all vendor questions in one place (e.g., a shared document).

- Publish a consolidated Q&A to all participants—avoid private answers.

- Stick to deadlines: vendors will take your seriousness from your adherence to your own timeline.

📘 Sievo’s advice: “Consistency builds trust and fairness.” Vendors respect organizations that communicate clearly and respond on time.

G. Focus on Performance and Outcomes, Not Features

A long list of “features supported: yes/no” doesn’t tell you if the solution will work for your use case. Instead, evaluate on metrics that matter:

- Data freshness: How often is it verified?

- Accuracy rate: What’s the historical average and how is it measured?

- Coverage ratio: What % of your ICP does it reach today?

- Latency: How long between a market event (funding round) and data availability?

- Integration success: How seamless is CRM ingestion?

💡 Ask vendors to include proof points—actual numbers, customer case studies, or live examples.

H. Require a Real Data Sample

Don’t buy data you haven’t seen. Ask vendors to show—not tell—their quality.

- Request a custom sample that mirrors your ICP or target region.

- Evaluate it using these lenses:

- Relevance (Do these companies fit your targeting criteria?)

- Accuracy (Are contacts real and reachable?)

- Signal freshness (When was the last update?)

- Hierarchy mapping (Are parent/sub relationships clearly defined?)

- Integration readiness (Is the file or API structured for ingestion?)

🧠 Think of it as a test drive before buying the car.

I. Plan for the Partnership Beyond the Purchase

An RFP isn’t a finish line—it’s the starting gun for an ongoing relationship.

Include a section in your RFP that asks vendors:

- “What does post-sale engagement look like?”

- “How often will you review data performance with us?”

- “What does your continuous improvement cycle look like?”

- “How do you handle evolving ICPs or shifting coverage needs?”

Set expectations for:

- Quarterly Business Reviews (QBRs)

- Refresh / data hygiene cadences

- SLA tracking and reporting frequency

📗 Harvard’s GovLab RFP guide emphasizes contract management and performance measurement as part of the RFP process—not an afterthought.

J. Keep it Human

Finally, remember that data buying is both technical and relational. You’re choosing a partner who’ll help shape your market visibility, your pipeline, and your revenue outcomes.

Be approachable in tone. Encourage dialogue. Tell vendors they can propose creative pilots or proof-of-concept tests.

💬 When you sound like a partner, you attract partners.

Step 4: How to Evaluate Data Samples & Vendor Fit

Hands-on guide for your Demand Gen/RevOps lens

When you get vendor responses and data samples, here’s how you evaluate:

A. Data Sample Quality

- Relevance: Does the sample reflect your target ICP (regions, company sizes, segments)?

- Signal clarity: If you asked for signals (new funding, new product launch, hiring ramp), are they clearly marked and explained?

- Freshness: How recent is the data? If you have a time-sensitive market (fast growth), stale data kills momentum.

- Coverage: Is the geography/segment coverage inclusive with your needs (global, verticals)?

- Accuracy / verification: Ask about how they verify data—automation vs human review, frequency of updates.

- Structure & integration readiness: Is the data in a format/integration method you can use (API, CSV, CRM enrichment)?

- Hierarchy & relational mapping: Especially for global GTM, do they support parent-subsidiary hierarchies, account relationships?

- Signal weight & prioritization: Have they prioritized the signals that matter to your outbound/expansion model?

B. Vendor Fit & Service Model

- Customization vs one-size-fits-all: Can the vendor tailor criteria/sourcing logic as your ICP evolves (very relevant for your model at LeadGenius)?

- Partnership mindset: Will they iterate with you, or just deliver a static feed?

- Support & onboarding: How will they integrate with your stack? What training, success resource, ongoing review?

- Scalability & flexibility: As you expand globally, add new products, or shift GTM, will they keep up?

- Cost model & ROI: Are pricing and contract terms aligned with value (e.g., signal uplift, pipeline lift) not just list size?

- References and case studies: Do they have customers similar to you (global GTM, complex hierarchies, multiple signals)?

- Security, compliance, data governance: Especially if you deal in regulated verticals.

- Innovation & road-map: Are they evolving (new signals, new geographies) or static?

Step 5: Fundamental Questions & Selection Process

Here’s a process and question set for selecting a data vendor:

Process

- Define need and scope (as above)

- Issue RFP (document) to shortlisted vendors

- Vendor responses + data samples

- Internal review: score submissions against criteria

- Shortlist 2-3 vendors: demos, deeper vetting, reference calls, sample validation

- Negotiate contract terms (SLAs, refresh, customization, pricing)

- Onboard vendor and integrate into your GTM/data stack

- Review performance regularly (via agreed KPIs) and iterate

Key Questions for Vendors

- What is your current global coverage (regions, segments, company sizes)?

- What signals do you provide (funding, hiring, tech stack, new location, ownership change, social growth) and how frequently are they updated?

- Provide a sample dataset for our target segment (e.g., companies in EMEA, size 500-2000, SaaS) with one or more signals.

- What is your accuracy/verification process? What is your error or decay rate?

- How do you handle account hierarchies (parent/subsidiary relationships, roll-up, duplicates)?

- What integration methods do you support (API, bulk CSV, CRM enrichment)? What data formats?

- How customizable is your sourcing logic or model? Can we adjust criteria over time?

- What support/onboarding/training do you provide? What is our dedicated point of contact?

- What is your pricing model (per signal, per record, subscription)? What is included/excluded?

- What are your SLAs (data refresh, availability, support response time)?

- Provide references: companies like ours (global, multi-signal, GTM) who can share their experience.

- What use cases have you solved that align with ours (for example, launching new product, expanding into new geography, signal driven outbound)?

- How do you handle data security, privacy, compliance (GDPR, CCPA, local laws)?

- What is your roadmap for new signals, geographies, evolving ICPs?

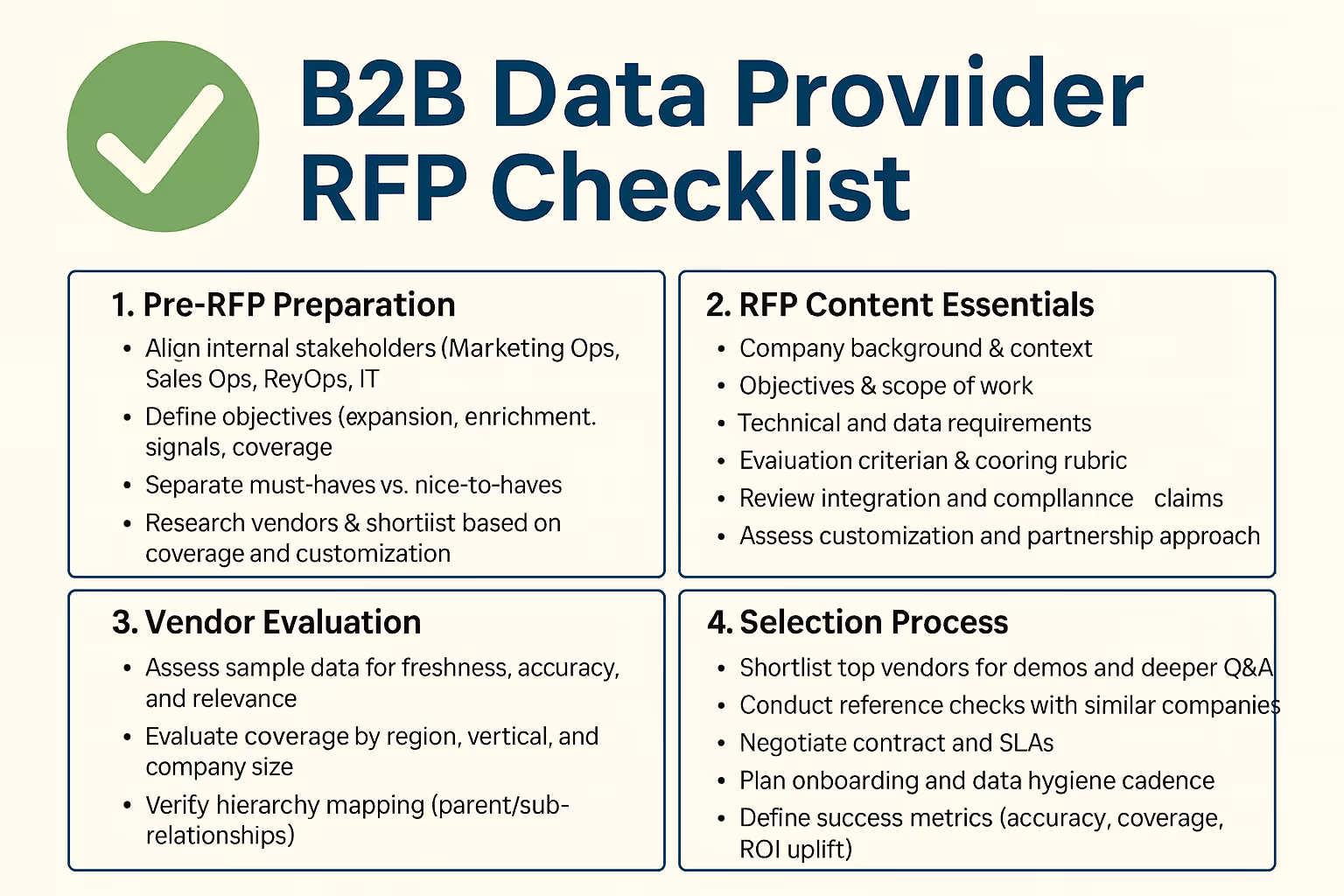

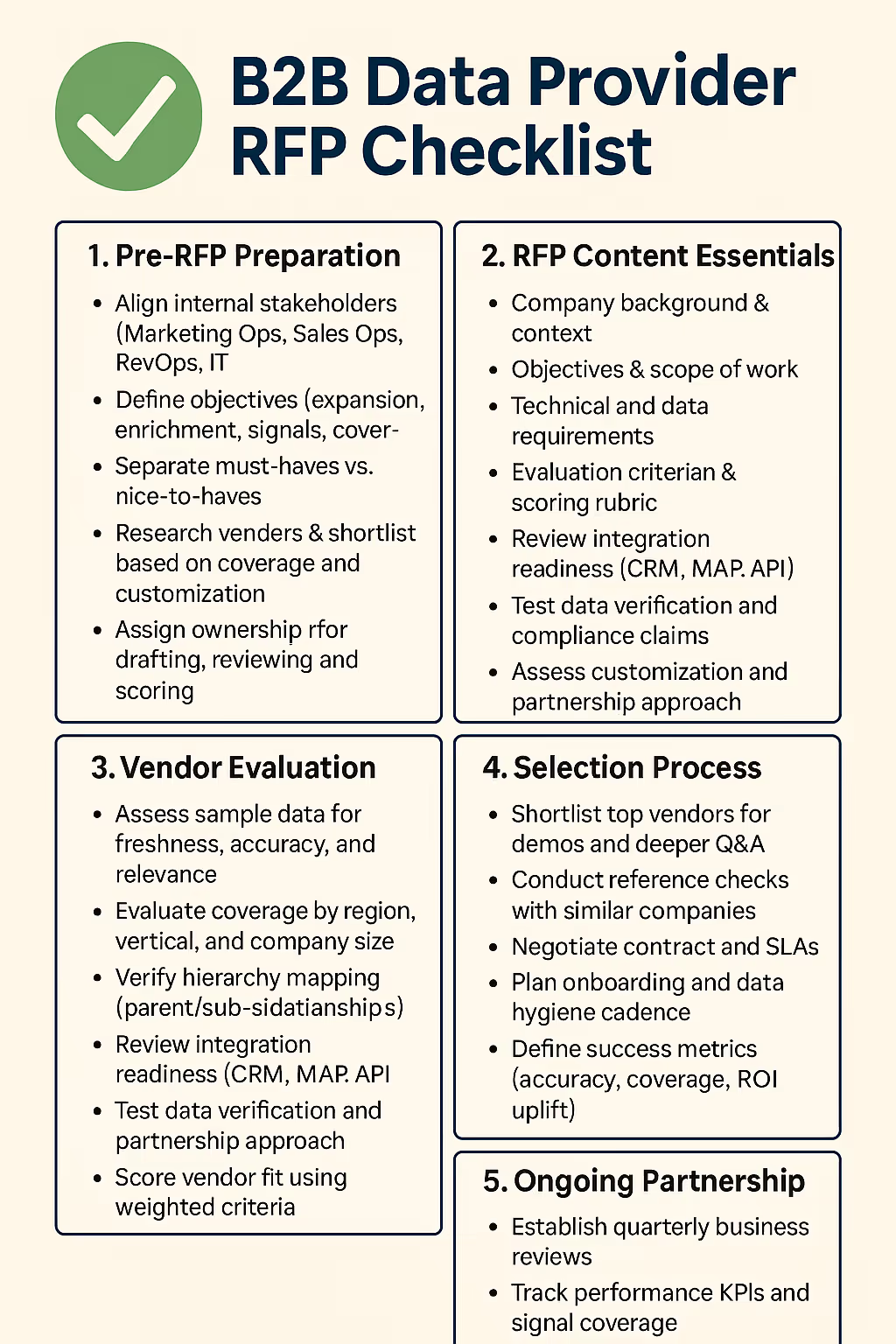

Step 6: Checklist You Can Use

Here’s your handy checklist to tick off:

- Stakeholders aligned and objectives defined

- Must-have vs nice-to-have criteria determined

- Market research/shortlist of potential vendors performed

- RFP document drafted with sections: cover, background, objectives, requirements, evaluation criteria, timeline, instructions, sample data request, contract terms

- Evaluation criteria matrix defined (weights, scoring method)

- Vendors invited and Q&A window set

- Responses received + data samples collected

- Data sample review: relevance, freshness, coverage, verification, integration readiness

- Vendor fit review: customization ability, partnership mindset, scalability, support, references, pricing model, innovation

- Shortlist vetted vendors (demos, reference calls)

- Contract negotiated (SLAs, refresh rate, customization, pricing)

- Onboarding plan created (integration, training, governance)

- KPIs defined for vendor performance (accuracy, refresh, incremental pipeline, signal-to-lead conversions)

- Post-award review process set (quarterly reviews, continuous improvement)

Parting Thoughts

At the end of the day, writing an RFP isn’t just about picking a data vendor—it’s about learning what kind of company you are and what kind of partner you want to be. The best RFPs don’t just ask for information; they invite collaboration. They reveal your priorities, your blind spots, and your ambitions. So take the process seriously, but don’t let it turn into a bureaucratic exercise. Use it as an opportunity to articulate your story: how your team uses data, what you’re trying to achieve, and what kind of innovation you’re ready to co-create. Because when you find the right partner, the RFP stops being paperwork—and becomes the first draft of your next chapter of growth.