Imagine navigating a small boat across the vast and tumultuous ocean. This boat, representing small and medium-sized businesses in America, faces a vast expanse of possibilities but also contends with unpredictable and often harsh conditions. The ocean's unpredictability mirrors the business landscape, where calm seas can suddenly turn into raging storms, representing economic downturns, changing market demands, or new regulatory challenges.

Now, consider the statistic that approximately 20% of small businesses fail within their first year, and about 50% falter by their fifth year. This is akin to our small boat facing the most critical test of survival in the initial part of its journey. The reasons for failure—such as cash flow problems, underestimating competition, or failing to meet market needs—can be compared to unexpected storms, navigational errors, or running out of provisions far from shore.

As the small boat progresses, those that survive beyond the treacherous first few years have learned to navigate these waters more skillfully, but the threat of a sudden squall remains ever-present. By the third year, a significant number of boats have already been claimed by the sea, analogous to the stark reality that only around 65% of businesses make it past their third year.

This journey emphasizes the need for preparation, resilience, adaptability, and a thorough understanding of the environment. Just as seasoned sailors learn to read the signs of the sea and adjust their sails accordingly, successful small and medium-sized business owners must remain vigilant, adapt to changing conditions, and navigate their businesses with precision and care to ensure their long-term survival and prosperity on the unpredictable seas of commerce.

The great news is that many small and medium-sized businesses (SMBs) are not just surviving; they are thriving. With over 33 million registered companies, the sheer volume can seem overwhelming for sales and marketing professionals aiming to pinpoint high-growth prospects. However, a more critical number to consider is the subset of these companies that are scaleups—businesses experiencing significant and sustained growth. Recent data reveals that approximately 45,000 US SMB with 10 to 1000 employees fall into this category of scaleups, based on headcount growth tracked over the past 2 years. We've made that analysis public as the data is revealing about the industries and sub-industries that are producing the most scaleups.

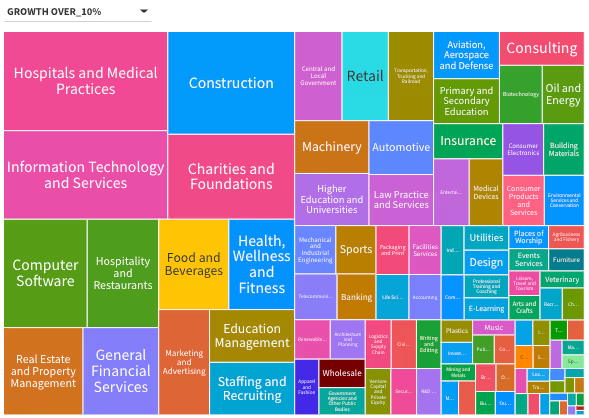

Interactive Infographic

We examined 8M+ SMBs over 2 years to find the sectors that were thriving with immense growth. This allowed us to identify the top 45,000 Scaleups. You can interact with the data below to see what sectors inside which sector groups are producing the most winners and scaleups.

How to Operationalize?

This statistic offers a gold mine of opportunities for those looking to sell to SMBs in America. But how do you efficiently identify and engage these fast-growing companies? The answer lies in the innovative use of artificial intelligence (AI) and large language models (LLMs).

Identifying Growth Signals with AI and LLMs

AI and LLMs are revolutionizing how we understand and interact with data. By monitoring various growth signals, such as headcount increases, these technologies can help us identify companies that are expanding rapidly. This is particularly relevant in the context of the 17 million US companies with online presences, a number that represents the most dynamic segment of the economy.

Creating a Roadmap for Sales Success

Leveraging insights on headcount growth allows sales teams to develop a targeted approach. Here's how:

- Prioritize High-Growth Prospects: By focusing on companies showing significant headcount growth, sales professionals can prioritize their outreach efforts towards businesses with the highest propensity to invest in new solutions and partnerships.

- Tailor Your Messaging: Understanding a company's growth trajectory enables you to customize your communication. Highlight how your product or service can support their expanding operations, address new challenges they may face, and contribute to their continued success.

- Optimize Timing: Engage with scaleups at the right moment. AI-driven insights can help you identify when companies are likely to need your offerings the most, based on their growth phase and current needs.

Implementing AI in Your Sales Strategy

Incorporating AI and LLMs into your sales strategy involves a few key steps:

- Data Integration: Leverage AI to analyze your existing customer data alongside external signals of headcount growth and other indicators of scaleups.

- Insight Generation: Use LLMs to interpret this data, identifying patterns and insights that can guide your sales approach.

- Actionable Strategies: Develop targeted outreach campaigns, personalized messaging, and timing strategies based on AI-generated insights.

Sector Analysis

- Apparel and Fashion: This sector shows a significant number of companies achieving over 20% growth, even outnumbering those in the over 10% growth category. This could suggest that businesses that successfully navigate the fast-changing trends and consumer preferences in fashion can experience rapid expansion. The winners here likely excel in online marketing, trend forecasting, and supply chain agility.

- Consumer Electronics: With a healthy distribution across all growth categories, the consumer electronics sector is robust, yet the highest concentration is in the over 10% growth. This indicates a competitive field with steady demand. Success factors might include innovation, brand loyalty, and adaptation to new consumer technologies.

- Consumer Products and Services: This sector has a balanced spread across growth categories, hinting at a diverse industry with various niches. Companies excelling in this sector possibly focus on customer experience, product differentiation, and value-added services.

- Cosmetics and Toiletries: Despite being one of the smaller sectors in terms of total companies, there's a notable interest in firms growing over 20%. This could be driven by trends towards personal care, organic and sustainable products, and e-commerce sales channels.

- Food and Beverages: This is the largest sector in terms of companies, with significant activity in the over 20% growth category. Success in this sector may be due to factors such as the rise in health-conscious consumers, the popularity of craft and artisanal products, and efficient distribution models, including direct-to-consumer sales.

Extended Sector Analysis Including Construction and Real Estate

Let's extend our analysis to include specific insights on the Construction and Real Estate and Property Management sectors, alongside the previously mentioned sectors. Given the data structure, we'll assume these sectors also follow similar growth categories and total numbers, and hypothesize on the factors influencing their performance.

Construction Sector

The Construction sector is unique due to its heavy reliance on local economies, regulatory environments, and the cyclical nature of real estate markets. Companies that are winning in this sector could likely be those that:

- Embrace technology, such as project management software and modern construction methodologies (e.g., modular construction), to increase efficiency and reduce costs.

- Have diversified their services to include renovations, sustainable and green building projects, catering to emerging market demands.

- Show resilience and adaptability to the regulatory environment and economic fluctuations, positioning them to take advantage of recovery phases in the economy.

Real Estate and Property Management

For Real Estate and Property Management, the winners in this sector are probably leveraging:

- Digital tools for property management, virtual tours, and online leasing to enhance customer experiences.

- Data analytics for market analysis, investment decisions, and optimizing rental yields.

- A strong focus on community and tenant engagement, enhancing retention rates in property management businesses.

Winners vs. Losers: Key Differentiators

Across all sectors, including Construction and Real Estate, winners are likely characterized by several key differentiators:

- Innovation and Technology Adoption: Utilizing technology not just for internal processes but also to enhance customer engagement and service offerings.

- Market Adaptation: Rapidly responding to changing market dynamics, consumer preferences, and regulatory changes.

- Operational Efficiency: Streamlining operations to reduce costs, improve quality, and enhance scalability.

Conversely, the losers in these sectors might be businesses that:

- Are slow to adopt new technologies or resist changing traditional business models.

- Lack agility in responding to market shifts or fail to anticipate future trends.

- Suffer from operational inefficiencies or have not diversified their service offerings to mitigate risks.

Construction and Real Estate: Why They're Winning

- Construction: Growth in this sector may be driven by increased demand in specific areas like residential construction, driven by low interest rates or governmental infrastructure projects. Companies capitalizing on green building and sustainable practices are likely seeing additional growth due to increasing environmental awareness and regulatory incentives.

- Real Estate and Property Management: The real estate sector benefits from trends like remote work, which has shifted residential and commercial real estate dynamics. Property management firms that offer enhanced digital services are likely outperforming peers by providing superior tenant experiences and operational efficiencies.

Conclusion

For those targeting SMBs in America, the road to sales success is paved with data. Specifically, insights into headcount growth offer a clear indicator of which companies are scaling rapidly and are ripe for outreach. By harnessing the power of AI and LLMs, sales teams can move beyond the traditional spray-and-pray tactics, instead deploying precision-guided strategies that target high-growth prospects with tailored messaging at the optimal time. This approach not only enhances efficiency but also significantly improves the effectiveness of sales efforts, unlocking new opportunities in the vibrant landscape of American SMBs.

As we continue to expand our tracking to encompass the full spectrum of impactful companies in the US economy, leveraging advanced technologies like AI and LLMs will be key to staying ahead in the dynamic world of B2B sales. For sales leaders, marketers, and revenue operations professionals, this is the moment to embrace the future of data-driven sales—a future where bespoke insights and tailored strategies lead the way to unprecedented success.

ABOUT LEADGENIUS & GLASS.AI

LeadGenius helps mid-market and enterprise revenue leaders acquire their best fit customers globally. LeadGenius uniquely sources account, contact and signal data on-demand and just-in-time using a proprietary blend of technology automation and human intelligence. LeadGenius is backed by some of the most prominent investors in the Silicon Valley including Sierra Ventures, Lumia Capital, Javelin Venture Partners and SJF Ventures.

Glass.ai is an AI research capability that deep reads the web to discover, understand and track the activities of millions of companies. Glass.ai technology reads web content from multiple sources across countries and languages. It is used by B2B corporates, governments, consulting and market research firms, universities and non-profits. These organizations use glass.ai to research sectors, find new clients, segment markets, and monitor millions of companies on growth signals and other indicators.