ZoomInfo, once a darling of the stock market and lauded for its innovative approach to B2B data provision, has seen its reputation and financial standing wane significantly over recent times. This decline is vividly illustrated by its plummeting stock price, which has tumbled from a peak of $70 per share in 2021 to languish under $16 per share currently. This stark depreciation reflects not just market volatility but underscores deeper, systemic issues within the company, ranging from slowing growth and shrinking retention numbers to poor renewal rates and customer service concerns.

A critical point of contention and a catalyst for ZoomInfo's waning favor among investors has been its markedly slowed growth trajectory. After years of rapid expansion, the stark 26% plunge in share value to an all-time low serves as a glaring indicator of the company's decelerating growth momentum. This downturn is not merely a reflection of market dynamics but a testament to deeper operational and strategic misalignments within the company.

Equally troubling for ZoomInfo has been the erosion of its client base, highlighted by shrinking retention numbers. In a sector where customer loyalty is paramount, such attrition not only impacts revenue but also erodes the company’s competitive positioning. The inability to retain clients, ostensibly due to dissatisfaction with product offerings or service quality, raises significant concerns about the company's value proposition and its alignment with customer needs.

Compounding these challenges are widespread criticisms of ZoomInfo's customer service and renewal policies. There has been a particular outcry over the company's auto-renewal policies, which have not only gone viral on LinkedIn for their contentious nature but also drawn widespread ire from the business community. Such policies, perceived as predatory by some, have tarnished the company's reputation, leading to public relations and customer satisfaction issues that inevitably impact financial performance.

Moreover, ZoomInfo's data leasing practices have come under scrutiny. Questions about the ethical implications and transparency of these practices have surfaced, further complicating the company’s operational landscape. In an era where data privacy and ethical use are under the microscope, such questionable practices could lead to regulatory scrutiny and erode trust among clients and prospects alike.

A comparative analysis of G2 reviews for various vendors including Zoominfo, Clearbit, Lusha, Apollo, and 6sense reveals significant user frustrations primarily centered around data quality, accuracy, and usability.

For instance, Zoominfo, despite its wide usage, has faced criticisms from users like Sara E. from Cloudflare, who expressed concerns about the data "doesn't get updated as fast as it should".

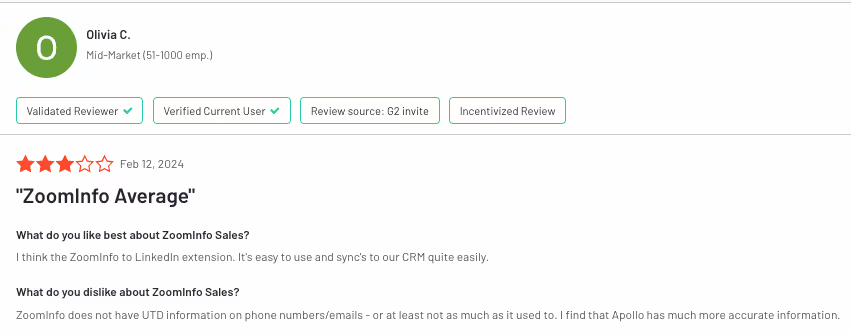

Similarly, Olivia C. from Novata highlighted Zoominfo's shortcomings in providing "UTD information on phone numbers/emails" compared to competitors.

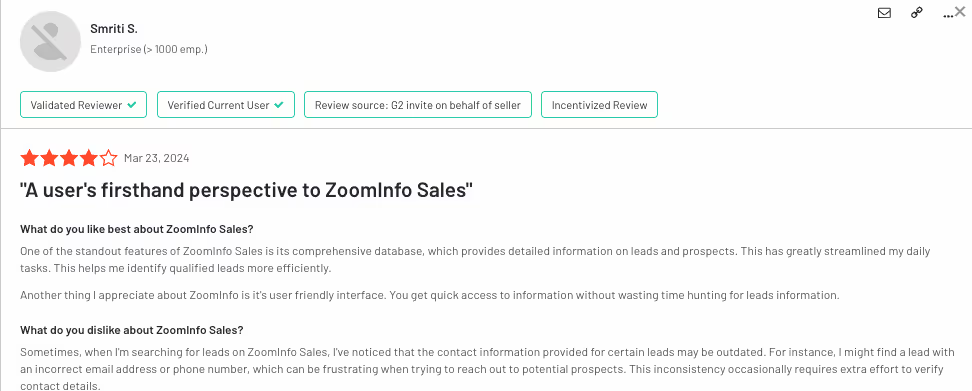

These issues are echoed across multiple reviews, with other users like Smriti S. also pointing out "the contact information provided for certain leads may be outdated", underscoring a recurrent theme of data inaccuracy and staleness.

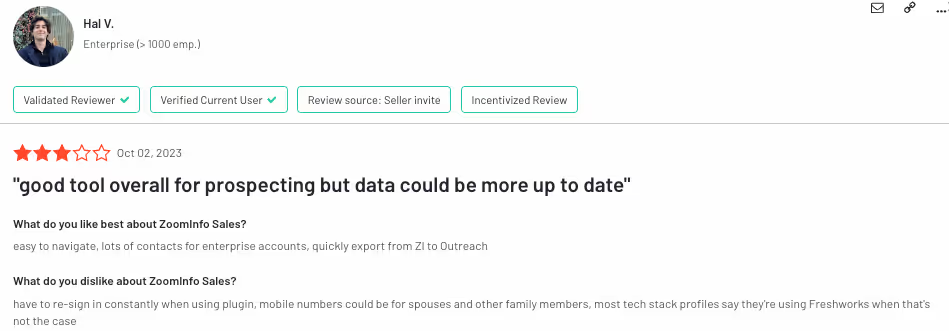

Furthermore, users from different platforms have voiced their dissatisfaction with the usability features. For example, Hal V. from Freshworks reported the inconvenience of having to "re-sign in constantly when using plugin" and encountering incorrect mobile numbers and tech stack profiles on Zoominfo.

On the other hand, Apollo users, such as Alex Hunter from PwC Canada, criticized the platform for providing a "small amount of mobile credits" and for "50% of the mobile numbers do not work or are inaccurate," revealing significant challenges in both the quantity and quality of data offered.

Lusha and Clearbit also do not escape criticism. Mike Y. from UiPath pointed out that despite Lusha's "good quality data in EMEA," there's feedback that "a lot of users don't have critical details such as phone numbers or email addresses", indicating gaps in data comprehensiveness.

Sidharth Iyer from Aisera found Clearbit's "platform enablement and user adoption needs to be improved" and mentioned a high failure rate in data enrichment, which could hinder effective data utilization.

Amidst these concerns, LeadGenius stands out by offering tailored data solutions that prioritize the freshness and accuracy crucial for successful B2B engagement. LeadGenius’ innovative approach in providing bespoke data, coupled with a commitment to high-quality, updated information, directly addresses the pain points identified by users of other platforms. By focusing on delivering precise, customized data that meets the specific needs of its clients, LeadGenius not only enhances the efficiency of sales and marketing strategies but also ensures a higher ROI by enabling targeted and meaningful outreach.

In summary, the collective feedback from G2 reviews underscores the essential need for reliable, up-to-date B2B data and points towards LeadGenius as a superior choice for teams aiming to access the best and freshest information in today’s rapidly changing business environment.